Saudi Prince Invests $300 Million in Twitter

Saudi Prince Invests $300 Million in Twitter

By MARK SCOTT – December 19, 2011 – NYT

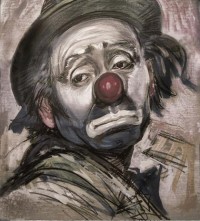

Prince Walid bin Talal holds assets worth an estimated $21 billion.Fahad Shadeed/ReutersPrince Walid bin Talal holds assets worth an estimated $21 billion.

LONDON — Prince Walid bin Talal of Saudi Arabia announced he had taken a $300 million stake in the social media site Twitter, as he continues to expand his holdings in the United States.

Prince Walid, who owns 95 percent of Kingdom Holding, said in a statement that the purchase was part of a strategy “to invest in promising, high-growth businesses with a global impact.”

With Twitter, Prince Walid — who also own stakes in American blue chip companies including Citigroup, General Motors and Apple — gains a foothold in the fast-growing social networking space. Under the terms of the transaction, Prince Walid and the Kingdom Holding Company purchased shares from early investors that value Twitter at $8.4 billion — the same value of its last fundraising round, completed this summer, according to two people with knowledge of the matter. Twitter did not issue any new shares.

Twitter, the microblogging service, has more than 100 million active users and is part of an elite group of Internet companies that have rapidly attracted users and carry multibillion dollar valuations.

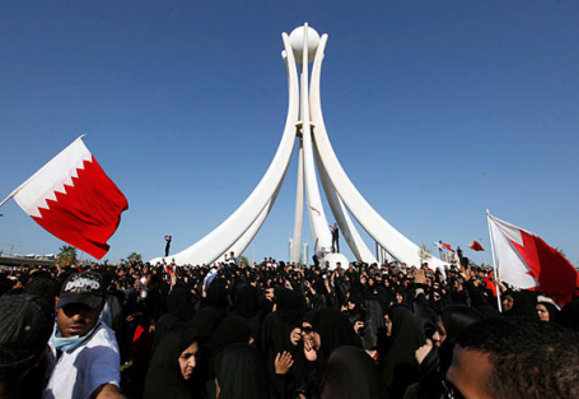

Twitter has been increasingly popular in the Arab world, where it was credited with playing a role in the recent social uprisings across North Africa and the Persian Gulf. Arabic-language messaging is the fastest-growing segment on Twitter, according to the data intelligence company Semiocast. The volume of Arabic messages increased 2,146 percent in the 12 months ended Oct. 31.

“We believe that social media will fundamentally change the media industry landscape in the coming years. Twitter will capture and monetize this positive trend,” Ahmed Reda Halawani, Kingdom Holding’s executive director of private equity and international investments, said in a statement.

Unlike many of its peers, Twitter is not rushing to go public. Earlier this summer, the company raised $800 million from private investors. The fund-raising effort, led by DST Global, the investment firm headed by the Russian billionaire Yuri Milner, valued the company at $8.4 billion. In the offering, Twitter issued $400 million worth of new shares, while early shareholders sold the rest.

Twitter’s patience contrasts with decisions by other social networking sites to brave the volatility of the public markets. Last week, the social game company Zynga raised $1 billion in an initial public offering that valued the company at $7 billion. But after its debut at $10 a share, Zynga’s stock closed at $9.50 on Friday.

Groupon, the daily deals site that raised $700 million in November, has been mixed. Shares of the company had dropped below the offering price, but have made a modest recovery of late.

The Saudi prince, who is a nephew of the country’s king, is one the of the Arab world’s richest men, holding assets worth an estimated $21 billion, according to Arabian Business magazine.

Kingdom Holding stock was up about 6 percent in midday trading on Monday in Riyadh, Saudi Arabia. …source