Saudi lead occupation of Bahrain taking it’s toll – fiscal wreckage abounds

Backstop Bahrain

Posted by Joseph Cotterill on May 26 14:15.

ft.com/alphaville

DIFC – Dubai, May 26, 2011

Thursday’s political risk datapoint:

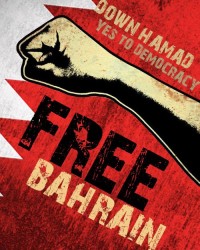

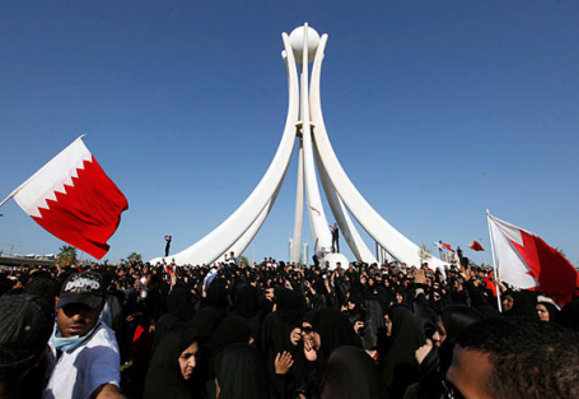

The main driver underlying Moody’s decision to downgrade is the significant deterioration in Bahrain’s political environment since February. The government of Bahrain has forcibly suppressed an uprising by the Shi’ah-led opposition with the backing of an intervention of armed forces from other member states of the Gulf Cooperation Council (GCC), most importantly from its neighbour Saudi Arabia. Political tensions in the country remain high and there seems little prospect of the underlying causes of the unrest being peaceably resolved, at least over the short term. The political outlook is therefore highly uncertain.

Moody’s believes that these events are likely to have damaged economic growth significantly, especially in services sectors such as tourism, trade and financial services. These sectors had previously been championed by the government in its effort to diversify the economy away from oil. The timing and pace of any economic recovery will very much depend on political developments. In any case, the negative effect on consumer and investor confidence will likely linger.

The crisis has also affected Bahrain’s public finances. In February, the government announced cash transfers to families, and in May the parliament approved an expansionary budget for 2011-12. The resulting rise in current expenditure is reducing fiscal flexibility.

Even as the Bahraini government is set to lift martial law at long last, Saudi and other Gulf military forces show no signs of leaving, for example.

So it’s a weird kind of backstop. More like a brutal embrace. But if we are talking backstops, isn’t interesting to note that Bahrain government paper has traded at around 100bps tighter than Dubai debt during the Arab Spring?

And that’s even counting the big rally in Dubai bonds this year, a significant reason for which was the United Arab Emirates’ own backstop of Dubai companies’ debt restructuring.…more