Oil Prices Surge as US escalates war on Iran and Syria

Oil prices surge as Iranian embargo comes into force and violence escalates in Syria

01 July, 2012 – Arab Money

Oil prices jumped sharply on Friday, breaking a bear market lock on the market as the European Union and Australian ban on buying oil from Iran came into effect today, a ban that Iran has always said would result in the closure of the Strait of Hormuz. Nymex crude surged nine per cent to $85-a-barrel on Friday, almost halving its decline this year.

The vital oil supply bottleneck in the Gulf of Arabia remained open today, although violence escalated in Syria with the attack on a funeral by the Syrian army leaving 85 dead.

Saudi up supplies

Saudi Arabia has raised oil supplies in recent months filling up stock piles around the world and has also re-opened old oil pipelines to the Red Sea bypassing the Strait of Hormuz for up to 20 per cent of its huge daily output.

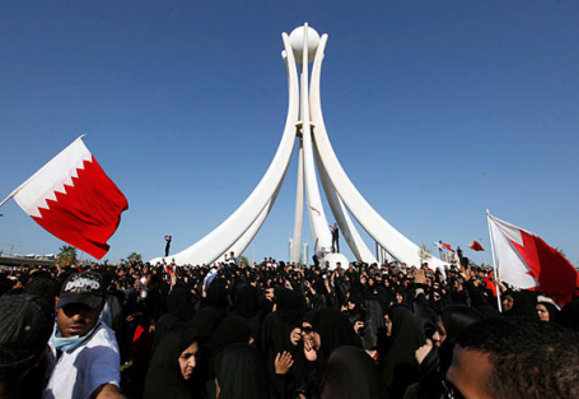

The UAE for its part will open up a pipeline taking almost all its oil to Fujairah next month, bypassing the Arabian Gulf entirely. That said hydrocarbon exports from Kuwait, Qatar and Bahrain would be vulnerable to any Iranian action.

In recent months the oil price has fallen sharply due in part to increased supply to offset the Iranian threat but also because of demand destruction by the slowdown in China and the recessionary conditions in Europe. The US economy has also grown less than expected.

Some commentators have even called this the start of a new, prolonged bear market for black gold with $100 oil having proven a turning point for alternatives like the development of shale gas in the US, although that has mainly acted to polaxe natural gas prices in North America not the price of gasoline for cars.

No bear market

ArabianMoney very much doubts oil is going into a real bear market. The loss of Iranian oil to global markets is the equivalent of Libya shutting down last year and much higher prices of oil were the direct result of that geopolitical event. …more

Add facebook comments

Kick things off by filling out the form below.

Leave a Comment